10 Things to Know Before Investing in Platinum

Platinum, a precious metal renowned for its rarity and versatility, has piqued the interest of many investors seeking to diversify their portfolios. Before diving headfirst into the world of platinum investments, it’s crucial to gather essential knowledge about this noble metal. In this post, we will explore ten vital factors to consider before investing in platinum, ensuring that your investment journey is both informed and successful.

Understanding Platinum’s Unique Properties

Platinum stands out among precious metals due to its exceptional properties. It is highly resistant to corrosion, incredibly dense, and boasts a beautiful silver-white luster. These characteristics make platinum ideal for a wide range of industrial applications, from catalytic converters in automobiles to jewelry and electronics. Understanding these properties is fundamental to making informed investment decision.

The Global Platinum Market

Platinum is a global commodity, and its market dynamics can be influenced by various factors, including geopolitical events, economic trends, and industrial demand. To invest wisely in platinum, stay informed about these market forces. Platinum production is concentrated in a few countries, with South Africa being the largest producer, followed by Russia and Zimbabwe. Mining disruptions in these regions can have a significant impact on supply and prices.

Types of Platinum Investments

Investors have several options when it comes to investing in platinum. The most common are:

- Physical Platinum: You can buy platinum bars or coins from dealers and store them securely; check out all of our available platinum products! This option provides you with the physical, tangible asset.

- Platinum ETFs: Exchange-traded funds (ETFs) offer exposure to platinum prices without the need to own physical metal. They are more liquid and accessible but come with management fees.

- Platinum Stocks: Invest in companies engaged in platinum mining and production. This option can provide diversification but also carries company-specific risks.

- Platinum Futures and Options: Advanced investors can trade platinum futures and options contracts on commodity exchanges.

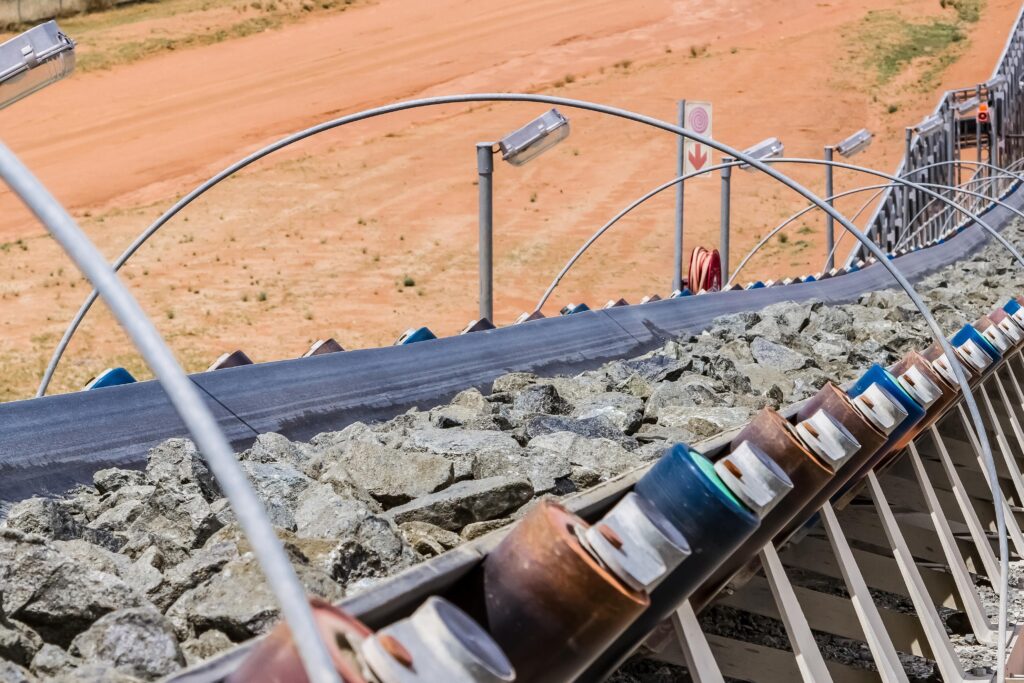

Supply and Demand Dynamics

Platinum prices are influenced by the balance between supply and demand. Be aware of the factors driving both sides:

- Demand: The automotive industry is the largest consumer of platinum, primarily for catalytic converters. Other industries, like jewelry and electronics, also contribute to demand.

- Supply: Production levels, mining disruptions, and recycling rates all impact the supply of platinum.

Market Volatility and Risk

Like any investment, platinum carries risks. Market volatility can lead to price fluctuations, and geopolitical events can disrupt supply chains. Moreover, platinum prices can be affected by changes in the global economy, such as recessions or inflation. Diversifying your investment portfolio can help mitigate these risks.

Industrial Use and Trends

Understanding platinum’s industrial applications is vital for predicting future demand. Keep an eye on technological advancements and shifts in industry preferences. For instance, as electric vehicles gain popularity, the demand for platinum in catalytic converters may change.

Storage and Security

If you choose to invest in physical platinum, you’ll need a safe and secure storage solution. Platinum is valuable, and ensuring its protection is essential. Consider options like a 3rd Party Bullion Depository facility, where your metal it titled allocated in your name. insured against theft loss and damage, and audited on a regular basis.

Legal and Tax Considerations

Investing in platinum may have tax implications depending on your country’s laws and regulations. Be sure to consult with a tax professional to understand the tax treatment of your platinum investments.

Market Liquidity and Exit Strategies

Before investing, consider how easy it is to buy or sell your platinum holdings. Liquidity can vary depending on the form of investment. Make a plan for exit strategies, such as setting price targets or time frames for holding your platinum assets.

Seek Professional Advice

Finally, it’s advisable to seek advice from financial experts or investment professionals before making significant platinum investments. They can help you navigate the complex world of precious metal investing and tailor your strategy to your specific financial goals and risk tolerance.

Conclusion

Investing in platinum can be a rewarding venture, offering diversification and potential for capital appreciation. However, it’s not without its challenges and risks. To make informed investment decisions, educate yourself about platinum’s unique properties, the global market, investment options, and the factors influencing supply and demand.

By understanding the key considerations outlined in this guide, you’ll be better equipped to embark on your platinum investment journey. Whether you choose to invest in physical platinum, ETFs, stocks, or futures, a well-informed approach will increase your chances of success in the fascinating world of platinum investments. Remember that seeking professional advice and staying updated on market trends are essential steps in your path to platinum prosperity.