How Much is a Kilo of Gold Worth?

Understanding the value of a kilogram of gold is integral for investors, hobbyists, and financial experts. How much is a kilo of gold worth is a common question we get here at Metals Mint. The price of gold per kilo fluctuates with market conditions, and various factors, including global economic stability, supply and demand, and investment behavior, impact it. Gold has been a valuable commodity for centuries, serving as a universal currency, a symbol of wealth, and a key asset in investment portfolios due to its perceived stability and intrinsic value.

Gold pricing is traditionally quoted by the troy ounce in financial markets, with one kilogram equaling 32.1507466 troy ounces. However, the convenience of calculating the worth of gold per kilo allows for easier comprehension of large quantities often dealt with by investors and institutions. The current gold prices and valuation methods can hinge on various dynamics, such as geopolitical events, currency fluctuations, and changes in supply routes. Investors often turn to gold as a hedge against inflation, contributing to its appeal as a ‘safe-haven’ asset during economic uncertainty.

Key Takeaways

- One kilo (kilogram) of gold equals 32.15 troy ounces of gold.

- The value of a gold kilo can be found by multiplying the price of gold in ounces by 32.15

The Basics of Gold Measurement

The assessment of gold’s worth is defined by its weight, which is typically measured in kilograms or troy ounces. Unpacking these units will clarify the value of gold in various quantities.

Understanding Weight Units

Gold’s weight is commonly expressed in several units but measured distinctly in the context of purity and trade. An ounce (abbreviated as “oz”) refers to an avoirdupois ounce in most goods, but gold is an exception. When dealing with gold, one should understand that the industry standard is the troy ounce, which weighs approximately 31.1034768 grams. Unlike other materials that might use standard ounces or even pounds, refined gold is quantified precisely, with one troy ounce containing exactly 31.1035 grams, highlighting the specification critical in gold trade and valuation.

One must also grasp the gram measurement, a metric unit of weight that equals one-thousandth of the base SI unit, the kilogram (kg). Just as any other kilogram, a kilogram of gold is precisely 1,000 grams. These units are universally recognized and used in the precious metals market, ensuring a common language for international trade.

Kilogram vs. Troy Ounce

The difference between the kilogram and the troy ounce is in their usage and origin. The kilogram is a base unit for mass in the metric system, and it’s used across a wide variety of applications not specific to precious metals. This metric unit represents a substantial quantity in gold measurement, often used for larger bars or reserves. In contrast, the troy ounce is a unit of weight customarily used for precious metals and gems. It is heavier than the typical ounce, with one kilogram of gold totaling around 32.15 troy ounces. Knowing the conversion between these two units is essential for accurate valuation and trading.

Current Gold Prices

The value of a kilogram of gold is subject to changes influenced by market factors and historical trends. Regarding the latest data, investors and interested parties must track the live gold price and understand its context.

Live Gold Price Factors

The live gold price is a dynamic figure, constantly fluctuating during trading hours due to supply and demand, market sentiment, currency strength, and geopolitical events. Currently, the spot price of gold in U.S. dollars can be instantly accessed, providing investors with real-time information to make informed decisions. You can see the live price of gold at the top of our Metals Mint website.

Historical Price Context

Analyzing the historical price context provides insight into the potential future movements of gold prices. Over the years, gold has been considered a safe haven asset, often appreciated during economic instability. One can discern patterns that might influence current valuations by examining past performance. For example, historical data from Business Insider reveals how the price of gold has fluctuated over a 52-week period, navigating between highs and lows in response to market forces.

Gold Valuation Methods

Accurate gold valuation is crucial for investors and individuals looking to understand the worth of gold holdings. It involves assessing both the weight of the gold and its purity level to determine its market value.

Calculating Gold by Weight and Purity

One standard method to value gold involves measuring its weight, typically in ounces or kilograms, and verifying its purity, often represented in karats. Pure gold is denoted as 24 karat; however, gold items may range in purity. For instance, an 18-karat gold item contains 75% pure gold. The ask price of gold, a term for the selling price on markets, is primarily provided per ounce. To evaluate a gold item’s value, one multiply the weight of the gold by its purity percentage and then by the current ask price.

Market Dynamics Affecting Gold Prices

Various market dynamics, including fluctuating demand and supply and changes in economic indicators such as inflation and interest rates, heavily influence the value of a kilogram of gold.

Market Demand and Supply Considerations

In financial hubs like New York and London, the trade of gold is largely dictated by supply and demand. The COMEX in Chicago is another key market where gold futures are traded, driving its price. Investors seek gold for portfolio diversification and as a hedge against market volatility, leading to fluctuations in demand. On the supply side, mining operations, their costs, and the discovery of new gold reserves affect how much gold is available in the market.

Effects of Inflation and Interest Rates

Gold is often called an inflation hedge because its price may increase when inflation does, preserving its value. Conversely, rising interest rates can lead to higher bond and savings account yields, drawing investors away from gold, which bears no interest. Central banks, including New York and London, monitor these factors to decide interest rates that can impact gold prices.

Global Gold Exchanges and Their Role

Gold exchanges worldwide play a pivotal role in determining the value of gold and facilitating its global trade. They are the hubs where participants worldwide can trade gold in a transparent and regulated environment.

Key Global Gold Markets

The London OTC market and the New York Commodities Exchange (COMEX) are prominent players in the global gold markets. London holds a significant position, often viewed as the center of global gold trading, and is responsible for a large share of the notional trading volume. New York’s COMEX, on the other hand, is a significant entity in the futures market and impacts gold pricing with its contracts.

Asia also possesses vital gold markets, with cities like Hong Kong and Shanghai critical contributors to the gold trading landscape. These markets cater to a vast geographic area and serve as crucial conduits connecting sellers, buyers, and investors in the gold trading supply chain.

Trading Hours and Locations

London operates an Over-The-Counter (OTC) market for gold where trading extends beyond traditional hours, offering greater flexibility for global traders. Meanwhile, COMEX in New York runs within defined trading hours, providing a structured environment for gold futures and options.

These gold exchanges’ trading hours and locations are strategically set to accommodate international investors and reflect the continuous 24-hour global trading cycle. America and Asia play vital roles, offering extended trading windows due to their time zones, which ensures that a gold market is active somewhere in the world at any given point in the day.

Investing in Gold

When considering the worth of gold, one must recognize the various vehicles for gold investments and their potential impact on future value.

Types of Gold Investments

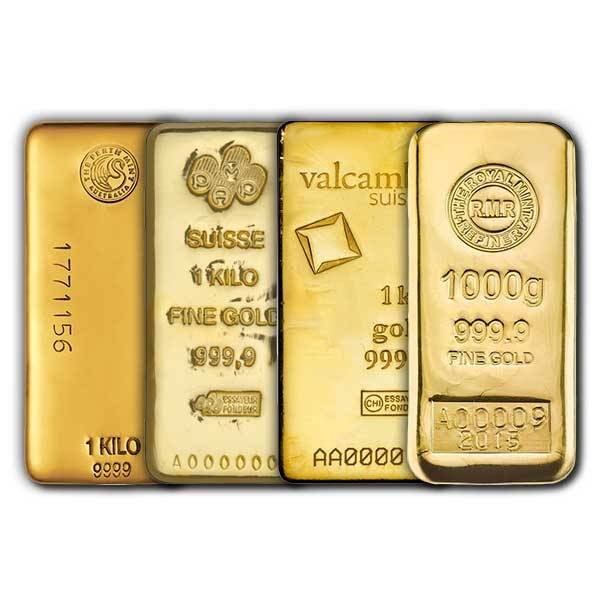

Investors have a range of options to gain exposure to gold. One prevalent method is purchasing gold bullion, which refers to pure gold as bars or coins. A gold bar can vary in size, but buying in kilos is a popular choice for substantial investments. These bars are often held as a form of wealth preservation or a hedge against inflation. Gold coins are a collector’s item and investment, often produced by government mints and known for their purity, such as the American Gold Eagle or Canadian Maple Leaf.

Future Value Predictions

The future value of gold is subject to many factors, including economic conditions, inflation rates, and market demand. Investors typically look at gold as a long-term investment. While short-term fluctuations in the worth of gold are common, many investors regard gold as a stable asset with the potential to maintain or increase its value over time. Gold’s reputation as a safe haven asset suggests that in times of economic uncertainty, its value will likely rise as investors seek stability.

Factors Influencing How Much a Kilo of Gold is Worth

The daily value of gold is subject to various dynamic elements, with the spot gold price and futures prices often serving as primary references for the current value. Additionally, various economic indicators directly influence the gold rate, leading to fluctuations.

Spot Gold vs. Futures Prices

Spot gold prices indicate the price for immediate delivery, reflecting the current value of gold. It serves as a benchmark for pricing among traders. The spot gold price can fluctuate daily based on immediate demand and supply. Contrastingly, futures prices account for gold to be delivered at a future date, incorporating predictions of future market conditions and risking either a high or a low price depending on the anticipated trends.

Economic Indicators and Gold Value

Investors closely watch the gold rate as an indicator of market stability. Economic indicators such as inflation rates, currency values, interest rates, and geopolitical events can cause the value of gold to rise or fall. For instance, a weak US dollar typically leads to a higher gold price, as gold is often viewed as a safe haven. In times of economic uncertainty, gold demand increases, elevating the spot gold prices.

Buying and Selling Gold

When engaging in the trade of gold, one must comprehend both market prices and the mechanics of transactions. Gold prices fluctuate regularly, influenced by market forces and investor behavior.

How to Determine Purchase Price

The purchase price of gold is predominantly determined by the spot price, which reflects the current market value of gold per ounce or kilo. Buyers can also encounter premiums, which are added above the spot price, accounting for factors like production costs and the seller’s profit. These premiums vary depending on the seller and the type of gold purchased, such as coins or bars.

- Bid Price: The highest price a buyer is willing to pay for gold.

- Ask Price: The lowest price a seller is ready to accept.

- The difference between these prices is known as the spread.

Understanding the Buying/Selling Process

When selling gold, the seller receives the bid price, which is often lower than the spot price. Sellers are motivated to achieve the highest possible bid price to maximize their gain or minimize their loss.

- Check or Wire Payment is typically expected in transactions, whether buying in person or through reputable online dealers.

It’s imperative for participants in the gold market to closely observe the bid and ask prices to identify the right moment for executing a trade.

Physical Gold vs. Gold Securities

Gold Bullion and Coins

Gold bullion is often sold as bars or ingots, measured in troy ounces or larger kilos. A kilo of gold bullion is equivalent to approximately 32.15 troy ounces. Meanwhile, gold coins are collector items that can carry additional value beyond their gold content, depending on rarity, design, and historical significance. Prices for gold bullion and coins fluctuate daily based on the gold spot price.

Gold Stocks and ETFs

Investing in gold stocks typically means buying shares of companies that mine or trade gold. Their value is influenced by overall stock market trends as well as the performance of the specific company. On the other hand, Gold Exchange-Traded Funds (ETFs) track the price of gold by holding either physical or gold-related financial instruments. This makes gold ETFs a more liquid option, allowing investors to gain exposure to gold prices without storing physical gold.

Gold’s Role in Diversifying Investments

Investing in gold is a time-honored strategy for diversifying their portfolios, mitigating market volatility risks, and protecting against inflationary pressures.

Gold as a Hedge Against Market Volatility

Gold is often viewed as a safe haven during periods of economic uncertainty. For instance, its price can be less influenced by factors that cause fluctuations in the stock market. Historically, gold’s value has an inverse relationship with equities; when stock prices drop, gold often gains value, providing a buffer for investors. Events such as COVID-19 can cause massive upheavals in financial markets, but gold’s relative stability is a counterbalance during such times.

Comparing Gold to Other Commodities

While gold can stabilize a portfolio, comparing it to other commodities like silver reveals different diversification aspects. Whereas silver can be more volatile due to its industrial uses, gold often remains steady, providing a more consistent form of diversification. Additionally, gold retains its intrinsic value over time, unlike commodities that can be consumed or that decay. The performance of gold is also less correlated to changes in interest rates, which typically affect the yield of interest-bearing assets, underscoring the strategic role of gold in asset diversity. In contrast to equities and bonds, gold has historically maintained its purchasing power in the face of rising inflation, reinforcing its role as a diversification tool.

Practical Information for Gold Investors

When investing in gold, one must consider the market value, which may be assessed per kilo, and the practical aspects, such as safekeeping and legal responsibilities. These are crucial for the comprehensive management of a gold investment portfolio.

Gold Storage and Security

Gold Storage Options include safe deposit boxes, home safes, and professional bullion storage facilities. Investors should evaluate storage costs and insurance options. Given gold’s high value-to-weight ratio, a kilo, which equals approximately 32.15 troy ounces, requires relatively small space yet needs robust security measures due to its value.

Security Considerations involve ensuring that the gold, irrespective of whether it is in coin or bar form and regardless of its purity, measured in karats, is safeguarded against theft and damage. Investors might choose allocated storage to ensure their gold is not commingled with others’ assets.

Tax Implications and Reporting

Taxation on gold investments varies by jurisdiction. Profits from selling gold may be taxed as capital gains. The percentage and reporting requirements depend on the investor’s tax residency.

- Reporting Requirements: Investors may need to report holdings over a certain threshold. Documentation for purchases and sales should include details like weight, karat level, and price.

Futures Contracts are an alternative investment method, allowing investors to buy or sell gold at a predetermined price in the future. Usually handled electronically, these contracts can impact taxation; therefore, it is crucial to understand the specific tax implications and reporting for futures contracts.

In conclusion, staying aware of the practical aspects of gold investment, from storage and security to tax implications, is as essential as monitoring the market value of this precious metal.