How to Invest in Platinum Bullion and Coins

Platinum, often dubbed the “rich man’s gold,” has been a symbol of luxury and wealth for centuries. But beyond its use in jewelry and industrial applications, platinum offers a unique investment opportunity. With its rarity and diverse applications, it’s no wonder savvy investors are turning their attention to platinum bullion and coins. If you’ve been considering diversifying your investment portfolio, this guide will walk you through the ins and outs of investing in this precious metal.

Historically, platinum has been valued for its strength, resistance to tarnish, and its beautiful silvery-white hue. Its price often surpasses that of gold, making it an intriguing option for those looking to invest in precious metals. But how does one go about investing in platinum bullion and coins? Let’s dive in.

What is Platinum?

Platinum, a member of the platinum group metals, is a lustrous, silvery-white metal known for its rarity and beauty. Often compared to gold and silver, platinum stands out due to its unique properties and applications. It’s denser and more durable than gold, making it a favorite for certain types of jewelry, especially wedding rings. But its allure doesn’t stop at aesthetics. Platinum’s resistance to corrosion and high melting point make it invaluable in various industries.

Applications of Platinum

Beyond the glint of jewelry, platinum’s applications are vast and varied:

- Automotive Industry: Platinum is a key component in catalytic converters, devices that reduce harmful emissions from vehicles. As environmental regulations become stricter worldwide, the demand for platinum in this sector continues to grow.

- Electronics: Platinum’s conductive properties make it essential in manufacturing various electronic components, including computer hard drives and LCD screens.

- Medicine: Due to its non-reactive nature, platinum is used in medical implants, pacemakers, and even in certain cancer treatments.

- Chemical Industry: Platinum acts as a catalyst in numerous chemical reactions, especially in the production of nitric acid and synthetic fuels.

- Jewelry: Its durability and natural white sheen make platinum a preferred choice for rings, necklaces, and other adornments.

Factors Driving Platinum Prices

Several factors influence the price of platinum in the global market:

- Supply and Demand: Given its wide range of applications, the demand for platinum often outstrips its supply. Its rarity plays a significant role here. It’s estimated that the total amount of platinum ever mined is just a fraction of the gold extracted over the ages.

- Industrial Needs: As mentioned, platinum is crucial in various industries. Any shift in industrial production or technological advancements can impact its demand and, consequently, its price.

- Geopolitical Factors: Most of the world’s platinum supply comes from South Africa and Russia. Political instability or labor strikes in these regions can disrupt the supply chain, leading to price fluctuations.

- Economic Health: Like other precious metals, platinum can act as a hedge against economic downturns. In uncertain economic times, investors often flock to tangible assets like platinum, driving up its price.

- Environmental Regulations: As countries become more environmentally conscious and implement stricter emission standards, the demand for platinum in catalytic converters rises, influencing its market value.

Understanding Platinum’s Value

Before you start investing, it’s crucial to understand what drives platinum’s value. Unlike gold, which is primarily a monetary metal, platinum has a wide range of industrial uses. It’s vital in the automotive industry for catalytic converters, and it’s also used in electronics, dentistry, and even in the production of certain chemicals.

The demand for platinum often outstrips its supply, given its rarity. In fact, it’s estimated that all the platinum ever mined would fit into a room no larger than an average living room! This scarcity, combined with its diverse applications, often results in price fluctuations. As an investor, staying informed about global industrial trends and demands can give you an edge in predicting platinum market movements.

Choosing Between Bullion and Coins

When it comes to investing in platinum, you have two primary options: bullion and coins. But what’s the difference, and which is right for you?

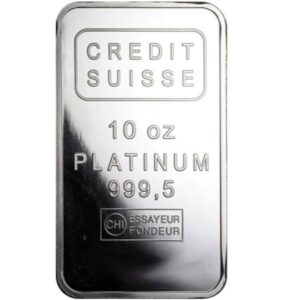

- Platinum Bullion: This refers to pure platinum in bar form like this 1oz bar from Valcambi, or this 10oz bar from Credit Suisse. Platinum bars can range in size from a single gram to several kilograms. They’re typically stamped with their weight, purity, and a serial number. Investing in bullion is a straightforward way to gain exposure to the raw value of platinum. It’s ideal for those who want a tangible asset without the nuances that come with coin collecting.

- Platinum Coins: These are minted by governments and carry a face value, though their market value is often much higher due to their platinum content, a couple examples would be this 1oz American Platinum Eagle or this 1oz Austrian Platinum Philharmonic. Coins can offer both the intrinsic value of the industrial metal and potential numismatic value, which is based on rarity, platinum demand, and historical significance. For those who appreciate history and artistry, coins can be a rewarding investment.

Where and How to Buy

Once you’ve decided on bullion or coins, the next step is making a purchase. Here’s how:

- Reputable Dealers: Always buy from established dealers with positive reviews and transparent pricing. Whether you’re shopping online or in person, it’s essential to ensure you’re getting genuine products at fair market prices. Visit us at www.metalsmint.com

- Storage: Consider how you’ll store your investment. While some investors prefer home safes, others opt for bank safety deposit boxes or professional vault services. Remember, platinum is a tangible asset, so its security is paramount. See our Storage Options here.

- Documentation: Keep all purchase receipts and any authenticity certificates. This documentation will be crucial if you decide to sell your platinum in the future or for insurance purposes.

Conclusion: The Platinum Opportunity

Investing in platinum bullion and coins offers a unique opportunity to diversify your portfolio and tap into the potential of a precious metal with both monetary and industrial value. Like all investments, it’s essential to do your research, understand market trends, and consult with financial professionals if needed. With the right approach, platinum can be a shining addition to your investment strategy.

When investing in any commodity, it’s important to be aware of the applicable tax laws. In the United States, platinum bullion and coins are considered collectibles under IRS regulations. As such, profits on sales may be subject to a higher capital gains rate than other forms of investment income.

Remember, the world of platinum investing is vast and ever-evolving. Stay informed, stay practical, and most importantly, enjoy the journey into the lustrous realm of platinum.

FAQs on Platinum Investment

What is the best way to invest in platinum?

The best way to invest in platinum depends on your investment goals. If you’re looking for direct exposure to platinum price, buying physical platinum in the form of bullion or coins is a popular choice.

Alternatively, you can invest in platinum ETFs (Exchange Traded Funds) or mining company stocks for a more hands-off approach. It’s essential to do thorough research and possibly consult with a financial advisor to determine the best method for your individual needs.

Is a platinum bullion a good investment?

Platinum bullion can be a good investment for those looking to diversify their portfolio with a tangible asset. Bullion bars offer a straightforward way to invest in the raw value of platinum without the nuances of coin collecting. However, like all investments, it’s crucial to understand market trends, storage costs, and potential risks before diving in.

Are platinum coins worth investing in?

Platinum coins can offer both the intrinsic value of the metal and potential numismatic value, which is based on rarity, industrial demand, and historical significance. For those who appreciate history and artistry, coins can be a rewarding investment. However, it’s essential to research individual coins, their market demand, and potential resale value.

How to buy platinum for investment?

To buy platinum for investment:

- Choose between bullion or coins based on your preference.

- Purchase from reputable dealers with transparent pricing and positive reviews.

- Consider online platforms or local dealers, depending on your comfort level.

- Always ensure the authenticity of the product and keep all purchase documentation.

Are platinum coins hard to sell?

The ease of selling platinum coins largely depends on the coin’s rarity, demand, and the current market conditions. Popular government-minted coins like the American Platinum Eagle are generally easier to sell than rare or less-known coins. It’s always a good idea to buy platinum bullion coins with a broad market appeal to ensure liquidity when you decide to sell.

Is platinum a better investment than gold?

Both platinum and gold have their unique advantages as investment vehicles. While gold has historically been a go-to hedge against economic downturns and inflation, platinum’s industrial applications can make its price more volatile.

Platinum is rarer than gold, which can drive its price up, but its demand in industries like automotive can also influence its market value. It’s essential to consider your investment goals, risk tolerance, and market research when deciding between the two.