Top 10 Silver Coins for Investment in 2024

Insights on Leading Silver Coins for Investors

Silver as a precious metal continues to captivate investors looking to diversify their portfolios. Silver coins stand out for their combination of artistic designs and investment potential. Opting for coins over bars often comes with the added peace of mind from government-backed purity and weight.

We observe that the most sought-after silver coins for investment purposes are those minted by sovereign governments. These coins are released yearly, maintaining consistent precious metal content. They are recognized for their liquidity and may provide a solid potential for return. Here’s an overview of notable silver coins that are highly regarded in the investing community:

- American Silver Eagles: A staple in investment portfolios, known for their high silver content.

- Canadian Silver Maple Leafs: Celebrated for their authenticity and .9999 fine silver.

- British Silver Britannias: They showcase a timeless design coupled with a legal tender status.

- Mexican Silver Libertads: Esteemed for their rich historical designs and scarcity.

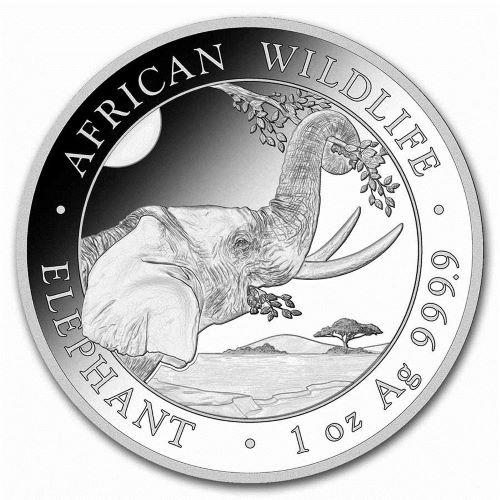

- Somalian Silver Elephants: Recognizable for their unique artwork and collectible nature.

- Austrian Silver Philharmonics: These coins harmonize aesthetics with .999 fine silver.

- Morgan Silver Dollars: Renowned among collectors for their numismatic value.

- 90% Silver “Junk” Dimes: Offer a lower premium, making them accessible to various investors.

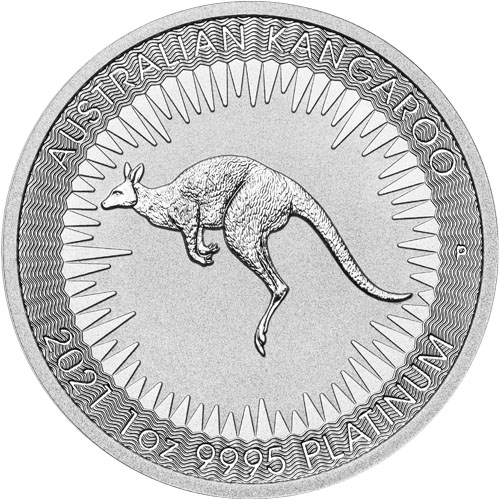

- Australian Silver Kangaroos: A blend of modern minting with a nod to Australia’s wildlife.

- Chinese Silver Pandas: Notable for yearly design changes and .999 silver purity.

Each of these coins brings distinct benefits, such as liquidity and potential historical significance, making them attractive addition to investment portfolios. While the spot price of silver is a key consideration, premium over spot and rarity also play critical roles in their appeal to both investors and collectors. Whether aiming to secure finance for retirement, safeguard against inflation, or simply appreciate the fine details of each mint, these silver coins hold a steadfast position in the world of precious metal investment.

1. American Silver Eagles

| Year of First Issue | Silver Content | Face Value | Purity Level |

|---|---|---|---|

| 1986 | 1 oz | $1 | .999 fine |

The United States Mint issues the Silver American Eagle as its official silver bullion piece. Each coin carries a hefty promise from the U.S. government vouching for its weight, silver content, and purity. These coins have become a staple in investment portfolios due to their high level of recognition and easy liquidation when necessary.

Our American Silver Eagles showcase a stunning depiction of Lady Liberty in stride, known as the Walking Liberty, which is based on the iconic 1916 half-dollar design by Adolph A. Weinman. In celebration of over three decades of issuance, the series embraced a new reverse design in 2021, featuring a majestic eagle clutching an oak branch, symbolizing continuity and strength.

2. Canadian Silver Maple Leafs

The Canadian Silver Maple Leafs stand out in the precious metals market with their distinctive features. Unveiled in 1988, each coin comprises one ounce of pure .9999 silver, placing them at the pinnacle of purity for standard silver dollar-sized coins.

Key Attributes:

- Purity: .9999 fine silver

- Weight: 1 oz

- Renowned Symbolism: Displays the classic and recognized Canadian maple leaf design

- Advanced Security: Infused with MintShield™ technology to diminish white spots, coupled with intricate radial line patterns for enhanced security

Investors often choose the Silver Maple Leaf coin for its excellent liquidity and inherent value, making it a prime choice within Canada and globally.

3. British Silver Britannias

The British Silver Britannia coins stand as a testament to British heritage, minted with an impressive fineness of .999 silver content. Emblazoned with the iconic image of Queen Elizabeth II, these coins also showcase Britannia in her chariot, a symbol of Britain’s indomitable spirit.

- Purity: .999 fine silver

- Design: Features Queen Elizabeth II and the iconic Britannia

- Mint: Renowned for quality from The Royal Mint

We recognize these coins for their liquidity and their embodiment of British history, making them a sterling choice for collectors and investors.

4. Mexican Silver Libertads

Mint Origin:

- La Casa de Moneda de Mexico, established mint in North America

Composition:

- .999 fine silver

Sizes Available:

- 1 oz

- 1/2 oz

- 1/4 oz

- 1/10 oz (and more)

Release Year:

- 1982

Design Significance:

The Mexican Silver Libertad‘s design holds significant cultural heritage, illustrating pivotal Mexican historical themes. Renowned for its aesthetics, this silver coin enhances collector portfolios while reflecting Mexico’s rich history. Its beauty and somewhat limited production runs make the Mexican Silver Libertad a valued collector’s item for numismatists and investors alike.

5. Somali Silver Elephants

As part of the distinguished African Wildlife Coin Series, the Somali Silver Elephant coins stand out. These coins honor Africa’s fauna and come in sizes to fit diverse preferences and budgets, ranging from 1/10 oz to 1 kilo pieces.

Since their debut in 1999, these coins have shown significant investment potential. Their composition of .9999 fine silver positions them alongside the most esteemed silver investment coins.

Collectors and investors alike appreciate the year-on-year updated design, which always venerates the elephant, a symbol of Somalia’s natural heritage.

6. Morgan Silver Dollars

- Composition: Each coin consists of 90% silver and 10% copper.

- Minting Periods: We minted these coins in two key phases, 1878-1904 and then in 1921.

- Investment Appeal: We find that certain specimens of these coins hold significant value above their silver content, especially those in finer conditions or from smaller mintages.

- Accessibility: For coins produced in years with higher production volumes, we can obtain them at prices marginally above their silver value.

- Popularity: Their historical significance and silver content make them a staple among both investors and collectors of silver.

7. Austrian Silver Philharmonics

- Release Year: 2008

- Composition: 99.9% pure silver

- Legal Tender: €1.5

Known for its exquisite design, the Austrian Silver Philharmonic coin is a must-have for investors and music lovers alike. Unveiled in 2008, the coin quickly gained recognition among enthusiasts.

The obverse side showcases the Golden Hall of Vienna, the illustrious venue of the orchestra’s New Year’s concert. The reverse presents a selection of instruments that represent the esteemed Austrian Philharmonic Orchestra, embodying Austria’s rich musical heritage.

Notably, it is the sole euro-denominated silver coin in the bullion market, with a face value of €1.5 and forged from .999 fine silver. The Austrian Silver Philharmonics are a tasteful option for diversifying one’s collection with European flair, all while maintaining modest premiums.

8. 90% “Junk” Silver Dimes

From mid-19th century until mid-20th century, dimes in the United States comprised primarily of silver—90% to be precise—with the remaining 10% being copper. These pieces weigh roughly 0.0715 troy ounces each. Though some have gained value as collectibles, there’s a category widely known as “junk silver coins,” which are sought after for their metal rather than collectible value. Dealers often sell these silver pieces in bulk.

While the price over spot for these dimes may appear steep, it’s the tradability of these smaller denominations that can make them a solid choice for those looking to safeguard their wealth against potential economic uncertainties.

9. Australian Silver Kangaroos

We consider the Australian Silver Kangaroo coins to be distinguished collectibles within the precious metals realm. Minted by Perth Mint since 1993, each coin proudly bears the imagery of the iconic red kangaroo against a decorative backdrop. With each release, the design is fine-tuned, maintaining the allure for enthusiasts and investors alike.

Key features include:

- Purity: Struck in .9999 fine silver

- Weight: Each coin contains one troy ounce of silver

- Nominal Value: Legal tender valued at AUD 1

These factors contribute to the coins’ consistency in liquidity and collectability.

10. Chinese Silver Pandas

The Chinese Silver Panda coin stands as a strong choice for those interested in precious metals. Depicting Beijing’s stunning Hall of Prayer for Good Harvests, the front of the coin is an homage to China’s architectural heritage. These coins are highly anticipated each year due to their annually changing panda imagery, symbolizing China’s natural wildlife.

- Fine Detail: 0.999 pure silver composition

- Legal Tender: Recognized currency in China

- Collectability: Coveted for diverse panda designs

- Exclusivity: Lower mintage than comparable bullion coins

Adding these to a collection not only diversifies it but also brings a touch of splendor due to their exclusivity and fresh annual designs. We emphasize their collectible and investable appeal, given their unique combination of low mintage and purity.

For those considering diversifying their portfolios with these coins, consulting with an investment professional is advised to discuss their potential role in your investment strategies.

Common Questions Regarding Silver Coin Investments

What Silver Coins Are Prime for Profit?

Investing in silver coins is an attractive option for many investors seeking precious metals, and certain coins stand out in the market. Typically, coins such as American Silver Eagles, Canadian Silver Maple Leafs, and Austrian Silver Philharmonics are known for their liquidity and profitability.

Top Silver Coins for Sustained Investment Growth

For long-term investment, we look for coins that have proven to steadily appreciate in value over time. Coins such as 90% “Junk” Silver Dimes and Morgan Silver Dollars have historical significance that can add to their investment potential alongside silver content.

Key Considerations When Purchasing Silver Investment Coins

When selecting silver coins for investment, we consider several factors:

- Purity: Aim for .999 fine silver or better.

- Recognition: Choose coins easily recognized by dealers.

- Liquidity: Focus on coins that can be quickly sold.

- Premium Over Spot: Consider the additional cost over the silver spot price.

- Numismatic Value: Some coins carry value beyond their silver content.

Investment Returns: Silver Coins vs Other Precious Metals

Silver coins can provide competitive returns compared to other precious metals, but it often depends on the specific coins and timing of the market. Historically, silver has been more volatile than gold, which can lead to both higher highs and lower lows.

Reliable Sources to Purchase Investment-Quality Silver Coins

Reputable dealers can be found through extensive online platforms or established local coin shops. It’s crucial to conduct due diligence, read reviews, and check ratings before making a purchase.

The Investment Worth of American Silver Eagles

American Silver Eagles are among the most reputable silver bullion coins worldwide. These coins are a staple in the portfolio of investors due to their government guarantee for weight, content, and purity.